BioBTX ready to take steps towards the building of its first commercial plant

Type of post: NEWS.

BioBTX is in a position to take significant

steps in its ambition to build a commercial plant to produce platform chemicals

from waste plastics with a full circular and sustainable process. BioBTX is an

innovative technology provider for the conversion of plastic wastes and biomass

into aromatics (Benzene, Toluene and Xylenes), essential chemicals for the manufacturing

of high-value specialty products. The use of waste plastic or non-food biomass

results in significant CO2 reductions, avoids incineration or

landfill, and replaces the use of oil as raw material.

Press release: “BioBTX – investments to realize

commercialization ambitions”, 14/1/2020.

Related posts:

- “BioBTX

and Teijin Aramid to jointly develop biobased aramid fibers”, 17/11/2018.

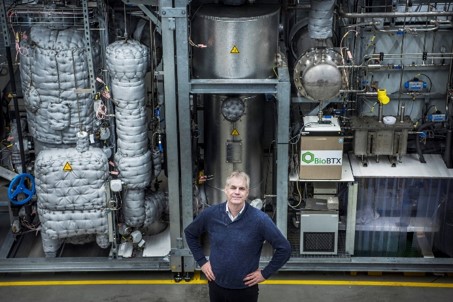

Figure 1. BioBTX is ready to take steps towards

commercialization (extracted from the press release in Dutch, photographer: Corné

Sparidaens)

BioBTX was started by regional entrepreneurs (KNN and Syncom) with technical and scientific contributions from Groningen University (RUG). The company has its facilities for the production of sustainable platform chemicals in Groningen (the Netherlands). The company has developed the Integrated Cascading

Catalytic Pyrolysis (ICCP) process. The integration of two steps allows high

flexibility in feedstock and process conditions. The technology has been proven

on lab and pilot scale with a number of patents and further IP under development.

A production unit for liquid biomass with a 10 kg/h capacity has been

operational since September 2018 with proven performance. An additional unit

for solid biomass as well as plastics and composites was installed in 2019 to

demonstrate full circularity options with the ICCP technology.

The first commercial production facility of

BioBTX is planned to be built in 2023. In December 2019, a Series B investment

round was completed. The Series C investment round for building the plant will

commence in 2020. Three existing (Carduso Capital, Vries Beheer and Lynnovation)

and two new investors (Groeifonds of the Economic Board Groningen and NOM) have

decided to finance the next steps.